“小蓝花”绽放,太平洋保险助力儿童罕见病在行动

7月16日,“爱不罕见益起向前”儿童罕见病关爱活动在上海儿童医学中心顺利举行。本次活动由太平洋保险携手上海宋庆龄基金会、上海交通大学医学院附属上海儿童医学中心联合主办。活动包含爱心援助、罕见病科普、义诊等环节,在积极提升社会大众对于罕见病认知度、参与度的同时,联动各方优势资源,为罕见病儿童和家庭提供帮助,让“小蓝花”的光芒正照进越来越多罕见病儿童的心扉。

来自上海儿童医学中心的李辛博士、李群博士、张倩文博士在现场分别就NOONAN综合征、德朗热综合征、ALSTROM综合征等三种罕见病种进行科普,深入浅出地介绍了在这些病种的发病机理、症状以及相关治疗方案的最新进展,让罕见病被更多人所了解、关注。

在义诊环节,来自儿童医学中心内分泌科、神经内科营养科、心血管内科等专业科室的7名专家参加了现场的义诊活动,为到场近百位罕见病儿童进行耐心细致的诊断,给予个性化治疗建议和日常养护指导。

2022年11月,太平洋保险携手上海宋庆龄基金会、上海儿童医学中心,在儿童罕见病领域开展“小蓝花”公益项目战略合作。该项目聚焦儿童罕见病的认知、治疗、康复、研究四个维度,帮助到罕见病诊疗、康复和社会融合等问题的解决。今年2月28日,“送你一朵小蓝花”线上公益义诊活动成功举行,“小蓝花”爱心权益在太平洋保险“蓝医保”小程序同步上线。太平洋保险积极探索用户+公益的线上化,带动更多社会大众一同参与到关爱罕见病事业中来。同年6月,“小蓝花”捕梦网活动正式启动,除帮助罕见病儿童圆梦外,还通过义诊等线下交流活动帮助到患儿和家庭,本次活动就是捕梦网活动的延续。

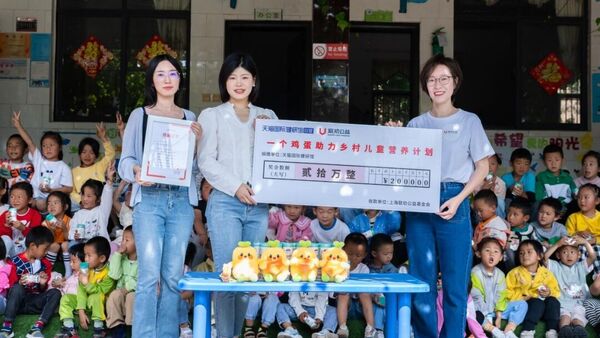

各方助力,涓滴成河。就在本次的活动现场,“小蓝花”公益项目的第一笔捐赠款按计划落实,太平洋保险为7位罕见病儿童分别提供2万元的费用支持,助力患儿治疗和康复。